Car Production in Africa: Which Global Brands Are Built Where?

(Toyota's factory in South Africa produces cars for the domestic market and for export. It holds the largest sales share in the country. Photo by ABP)

The Legacy of Japanese Used Cars vs. Expectations for Local Manufacturing

Japanese vehicles dominate the roads in Africa, making up approximately 90% of vehicles in some markets. This includes popular passenger models like Toyota and Suzuki, as well as vans such as the Toyota HiAce, Nissan Caravan, and Suzuki Every, which are often converted for use in public transport.

However, with the exception of South Africa and Egypt, about 80–90% of vehicle registrations are used imports, primarily from Japan. The trade in used cars is a significant business relationship between Africa and Japan.

In response, governments across Africa are seeking to decrease their reliance on used cars by aiming to establish local vehicle manufacturing. This "produce locally, sell locally" policy is intended to foster a wide range of domestic parts industries, secure sustainable employment, and preserve foreign currency reserves.

To facilitate this shift, it is essential to limit the import of used cars and establish preferential tax measures—such as reduced customs duties and corporate taxes—for automobile production. South Africa and Egypt have enacted policies such as banning the import of used cars, especially South Africa, which has implemented preferential tariff measures, making it the largest new car producer in Africa.

Beyond domestic sales, South Africa also serves as an export hub for cars and automobile parts. Toyota exports Corollas and other models to Europe, while BMW and Mercedes-Benz export to the United States and other countries.

Africa’s Automotive Production Hubs

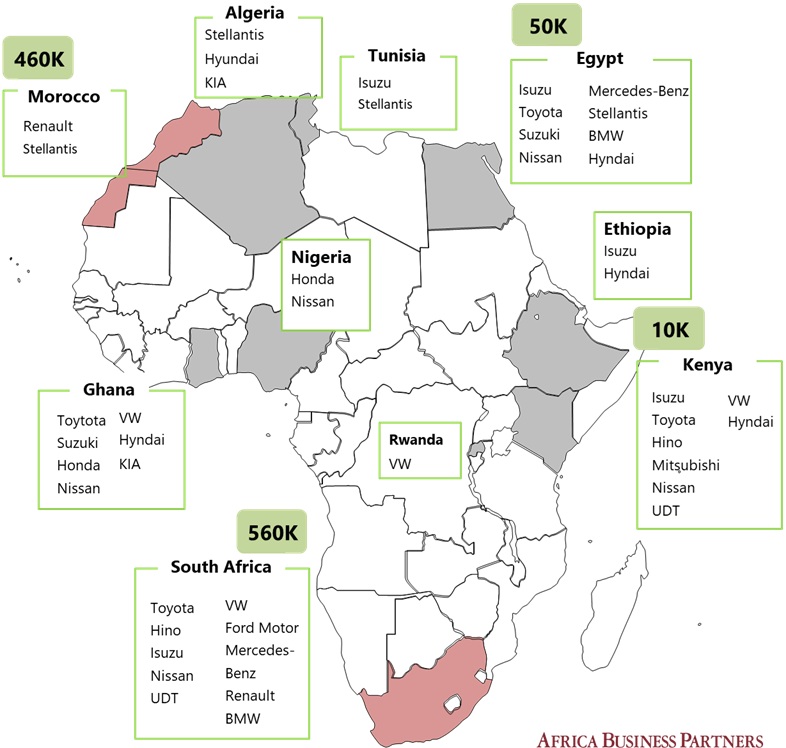

Manufacturing locally requires three key factors: (1) supportive industrial policies, (2) a sufficient market scale to justify the investment, and (3) adequate technical capacity, supported by local parts sourcing mandates. Currently, ten African nations have established CKD/SKD assembly plants that meet these criteria: South Africa, Morocco, Egypt, Kenya, Algeria, Tunisia, Ghana, Ethiopia, Nigeria, and Rwanda.

African countries that produce automobiles and their yearly production numbers (2023)

South Africa is the leading producer on the continent, manufacturing approximately 560,000 vehicles per year. Due to used-vehicle import bans and incentives, around 210,000 vehicles are sold domestically (20% passenger vehicles and 50% commercial), while approximately 350,000 are exported.

Major Japanese brands, such as Toyota, Hino, Isuzu, Nissan, and UD Trucks, operate manufacturing plants here, while others, including Suzuki, Honda, Mitsubishi, Mazda, Daihatsu, Subaru, and FUSO, focus on importing and distributing vehicles.

Morocco produces about 460,000 vehicles annually, primarily for export to Europe. The domestic market accounts for approximately 170,000 units. The government has successfully attracted French manufacturers, such as Renault and Stellantis, by investing in export zones and infrastructure.

Egypt has an annual production rate of approximately 50,000 vehicles, primarily for domestic consumption, with restrictions on the import of used vehicles. Locally assembled brands include Nissan, Chevrolet, and Chery, while Toyota, Suzuki, and BYD are among the brands that lag behind.

Kenya has a history of assembly operations dating back to 1977, including the production of the Toyota Land Cruiser. Shared-assembly plants serve multiple brands, and Isuzu operates its own acquired facility. Isuzu currently leads national vehicle sales, often converting trucks into buses.

Ghana, Ethiopia, Rwanda, and Nigeria have recently started vehicle assembly operations. Ghana is particularly notable, as its automotive policy enacted in 2019 has spurred foreign investment in the sector.

Japanese OEM Strategies in Africa

Toyota Motor Corporation

Toyota operates plants in South Africa, producing approximately 130,000 passenger vehicles annually, and maintains the No. 1 market share in passenger cars, ahead of Volkswagen. In Kenya and Egypt, production is outsourced to local assemblers. The most popular model is the Hilux, noted for its durability, along with strong sellers such as the Corolla Cross, HiAce, and Fortuner. In Egypt, the production of the Fortuner is particularly noteworthy. Recently, Toyota began producing the Hilux in Ghana through a facility operated by Toyota Tsusho. Toyota vehicles in Africa are distributed through Toyota Tsusho as part of their alliance with Toyota Motor Corporation.

Suzuki

Suzuki has made significant strides in South Africa, selling around 50,000 units and achieving a top 3 market share. The company does not have local manufacturing and instead imports models like the Swift, Ertiga, and Baleno from Gujarat, India. It also engages in local production in Egypt (through a joint venture) and Ghana (via the Toyota Tsusho facility). Suzuki's vehicles are popular for personal use and ride-hailing services (such as Uber), providing value and fuel efficiency amid rising fuel prices. Additionally, Suzuki’s collaboration with Toyota enhances its reputation for quality, and its models are often considered “affordable Toyotas,” distributed through Toyota Tsusho’s extensive dealer network.

Isuzu

Isuzu manufactures trucks and buses in South Africa, Kenya, Egypt, and Tunisia, and recently entered the Ethiopian market, with plans to expand to Ghana next. The brand enjoys high trust and recognition locally, particularly in Kenya, where many trucks are converted for use in bus services. In Africa, Isuzu's annual sales range between 60,000 to 80,000 units, with roughly half being pickups such as the D-Max, which is also produced locally in South Africa.

Nissan

Nissan assembles the Navara in South Africa and the Sunny in Egypt. It became the market leader in Egypt in 2023, where the country also promotes the export of locally assembled Sunny vehicles to Gulf nations.

Honda

Honda has produced motorcycles in Nigeria since 1981 and automobiles since 2015. Motorcycle production began in Kenya in 2013. While the company previously assembled cars in South Africa (through contracts), it now focuses solely on sales. In 2023, Honda commenced four-wheel assembly in Ghana.

Yamaha Motor

Yamaha produces motorcycles in Nigeria through a joint venture with Toyota Tsusho and distributes them in Kenya.